Temporal Portfolio Theory – Introduction

Modern Portfolio Theory MPT is now over 65 years old and was developed long before computers were available for analyzing daily market data. MPT's development was inherently limited to long-term statistical analysis of market data and portfolios. Without time domain (temporal) data analysis, there could be no daily trend/momentum data analysis; which limited MPT's algorithm investing to simplistic buy-and-hold diversification models. It's time to extend MPT's framework to embrace time domain data (momentum) and the many signal processing technologies that have since been developed, perfected, and successfully deployed for Ethernet, WIFI, seismic sensors, and image processing. It has long been proven by both

academic studies and industry studies alike that market data contains trend information that can improve the probability of making better investment choices. Temporal Portfolio Theory extends MPT by integrating the cross-disciplinary sciences of

Matched Filter Theory , Differential Signal Processing, Fuzzy Logic, and Holistic Risk Management within a layered Portfolio-of-Strategies framework to measurably improve both risk and return performance. The primary components of Temporal Portfolio Theory are outlined below.

This is not your granddad's portfolio theory!

True Sector Rotation®

True Sector Rotation is the method of owning the one, and only one, best trending fund at any time. It’s quite distinct from the half-hearted partial over- or under-weighting of multiple sectors practiced by fund managers. The trend leader is in fact the best bet and True Sector Rotation treats it as such. Economic cycles drive market cycles, and individual market sectors generally perform best during a particular phase of the economic cycle. If market sectors were like pistons in an investment engine, then the smoothest and most powerful ride would be achieved when each sector is owned only when it is delivering its power stroke. AlphaDroid is not a market timing system that attempts to predict what market sectors “should” be doing next month based on cycles, patterns, or fundamental data. Instead, AlphaDroid’s investment portfolio management software measures what market sectors “are” already doing and selects the one best trend leader to own from a set of up to 12 candidate funds.

It is only by owning the trend leader and avoiding the laggards

that one can simultaneously improve returns and reduce risk.

StormGuardTM Market Crash Protection

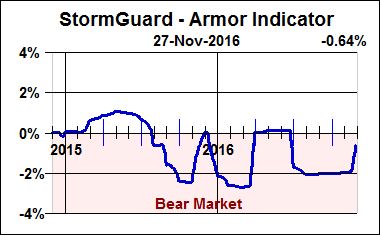

While our True Sector Rotation algorithms inherently avoid poorly-performing funds, our StormGuard algorithm monitors overall market health and advises Strategies to move to safety during a market storm. The StormGuard Indicator will typically range in value from -4% to +4%. Although you can select from among six different algorithms for down-market protection, our StormGuard-Armor Indicator is the industry’s best performing market sentiment indicator by far. It incorporates three distinct data sources with 12 different measures to ascertain whether the return prospects outweigh the risk conditions of the market. It is designed to perform a balanced optimization to simultaneously reduce whipsaw losses resulting from knee-jerk reactions to market dips by not reacting too quickly, and to minimize the crippling losses from long duration bear markets by not reacting too slowly. StormGuard-Armor’s value is calculated daily.

View A 5-Minute Demo Of Our Software

Start Your 30-Day Free Trial

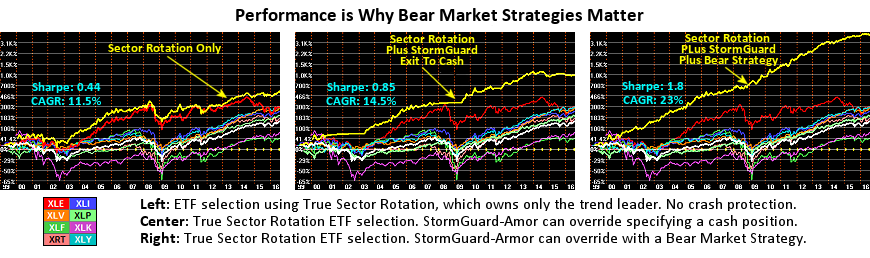

Integrated Bear Market Strategies

When StormGuard (a market direction indicator) signals that market conditions have become bearish, a Bear Market Strategy automatically takes charge and selects from a list of trusted safe harbor investments, such as cash, money market funds, bond funds, gold bullion, or US treasuries. While numerous market direction and sentiment indicatorshave been developed over the years, but none of them come close to the performance provided by StormGuard-Armor. The remarkable difference between the yellow equity curves in the three Strategy charts below illustrate the combined importance of StormGuard-Armor and Bear Market Strategies.

The yellow equity curve, compound annual growth rate (CAGR) and Sharpe Ratio (risk-adjusted return) in each chart above illustrate why Bear Market Strategies matter. All three investment Strategies rely on the True Sector Rotation algorithm to determine which one of the eight candidate SPDR sector ETFs to own each month during bull markets. However, the leftmost Strategy has no market crash protection, the center Strategy additionally utilizes StormGuard-Armor to determine when to exit the market to the safety of cash, and the rightmost Strategy further utilizes StormGuard-Armor with a Bear Market Strategy.

Strategy-of-Strategies

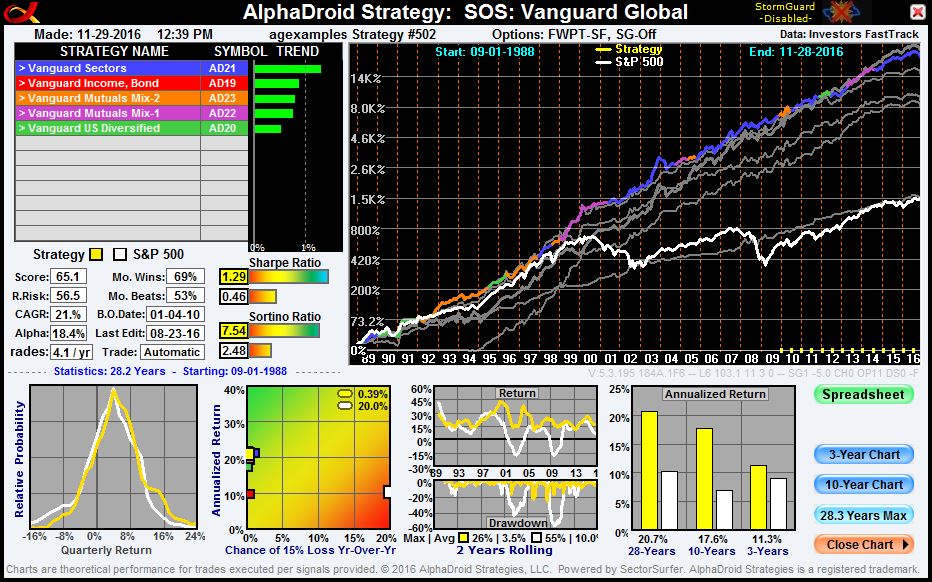

While an AlphaDroid Strategy selects the trend leader from among a set of candidates funds or stocks, a Strategy-of-Strategies (SOS) selects the trend leader from among a set of candidate Strategies. Thus, one owns the best performing fund of the best performing Strategy. The primary benefit of an SOS is to make sure that if the strategy you are using falters for any reason, the SOS will automatically switch you to an alternative Strategy that has not faltered. For example, the Strategy you own could temporarily get a "flat tire" in the future because you didn't quite have the perfect set of candidate funds. This can easily happen if you choose not to include a particular asset class or sector fund as one of the candidates because it had not performed well for a few years. No one can predict when political events or new discoveries will suddenly change the prospects for a previously poor-performing fund. A Strategy-of-Strategies is a form of insurance designed to reduce the risk of selection bias. This Vanguard SOS demonstrates the principle.

Portfolio-of-Strategies

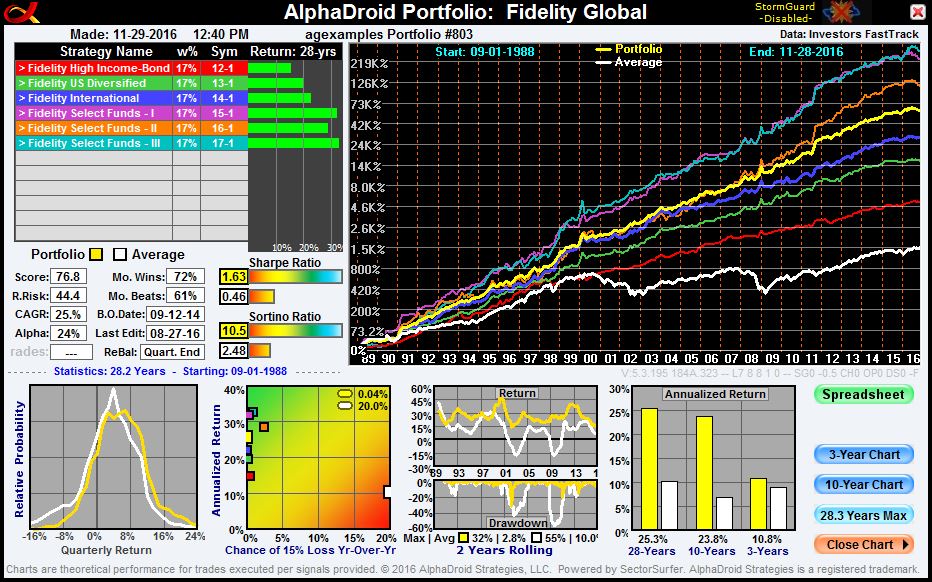

A classic Portfolio consists of a set of allocation-weighted funds where the Portfolio owns a set portion of everything on the list. By definition, the Portfolio performance will reflect a weighted average performance of the Portfolio's funds. To improve performance of a classic Portfolio, the funds in the Portfolio must be selected to have better performance characteristics. A dynamic means of selecting funds could therefore improve Portfolio performance. For example, utilizing a set of Strategies, each of which selects its own trend leader, will produce a Portfolio composed of trend leaders. The return performance of the Portfolio-of-Strategies will be the average of the returns or the selected trend leaders. The volatility risk for the Portfolio-of-Strategies will be lower than the average risk of the funds to the degree that the funds are uncorrelated. Note the particularly high Sharpe ratio and smooth equity curve for this Portfolio-of-Strategies holding six Fidelity fund Strategies.

Contact Us With Your Questions

Forward-Walk Progressive Tuning

The gold-standard for backtesting performance of a predictive algorithm (for markets, environment, sports, etc.) is the Forward-Walk Progressive Tuning methodology. A first set of test data tunes the algorithm’s parameters for subsequent use walking forward in time. After each subsequent 6-month period, the algorithm is re-tuned for walking forward through the next 6-month period, thus eliminating hindsight bias in testing. If performance is maintained during the forward walk periods, then tuning did discover a reliable character. To the degree performance declines, it is because the better performance path is actually un-discoverable by the algorithm because significant events were not reasonably predictable. Forward-Walk Progressive Tuning is an integral part of every AlphaDroid Strategy.

Automated Polymorphic Momentum

Both Information and Detection Theory dictate that the probability of making an excellent investment decision is directly proportional to the signal-to-noise ratio of the employed momentum indicator signal. While Matched Filter Theory actually specifies the momentum filter shape and duration for optimum signal-to-noise ratio, Differential Signal Processing further eliminates common mode noise from the decision process. The term “polymorphic” indicates that the momentum filter is both adaptive in shape and duration to accommodate (a) the diverse character of various equity classes (i.e. bonds, market indexes, sectors, REITS, and commodities), (b) the evolving character of the market, and (c) the evolving character of Strategies as funds with shorter histories begin to participate. See our NAAIM Wagner Award technical paper: “Automated Polymorphic Momentum“

Holistic Risk Management

Risk is not a one-dimensional problem cured by a single act of diversification. There are numerous sources of risk to face that relate to companies, funds, strategies, markets, political events, natural disasters, and even personal matters. Holistic Risk Management examines and addresses the relevant sources of risk within an entire system. AlphaDroid portfolio software was designed to reduce risk on many levels, as described in our white paper “Conquering the Seven Faces of Risk“.