September Pushes Higher – October Rough Start

Summer Volatility Quiets in September

August’s brief Black Swan event was triggered by Bank of Japan interest rate policy changes that led to a rapid unwinding of the Yen carry trade and a steep market selloff. The BOJ surprisingly softened its stance a few days later, halting further market damage and spurring a rapid world market rebound. Although September began with a half-hearted retest of the recent selloff, it reverted to a low-volatility climb to new market highs by month end, supported by the Fed’s half-point interest rate cut.

October Surprises Already Arriving

Although Iran’s threat to retaliate for Israel’s recent lethal strikes against Hamas and Hezbollah leaders was well known, it hadn’t materialized until this morning. As US markets opened, they quickly and steadily declined as news of Iran’s 180 missile attack on Israel sank in. Concern is very high regarding the involvement of other countries, oil production stability, and international shipping route safety. Other October monkey wrenches may include an escalation in the war for Ukraine or a lengthy US dockworkers’ strike that could halt half the nation’s ocean shipping.

Will We Climb the Wall of Worry?

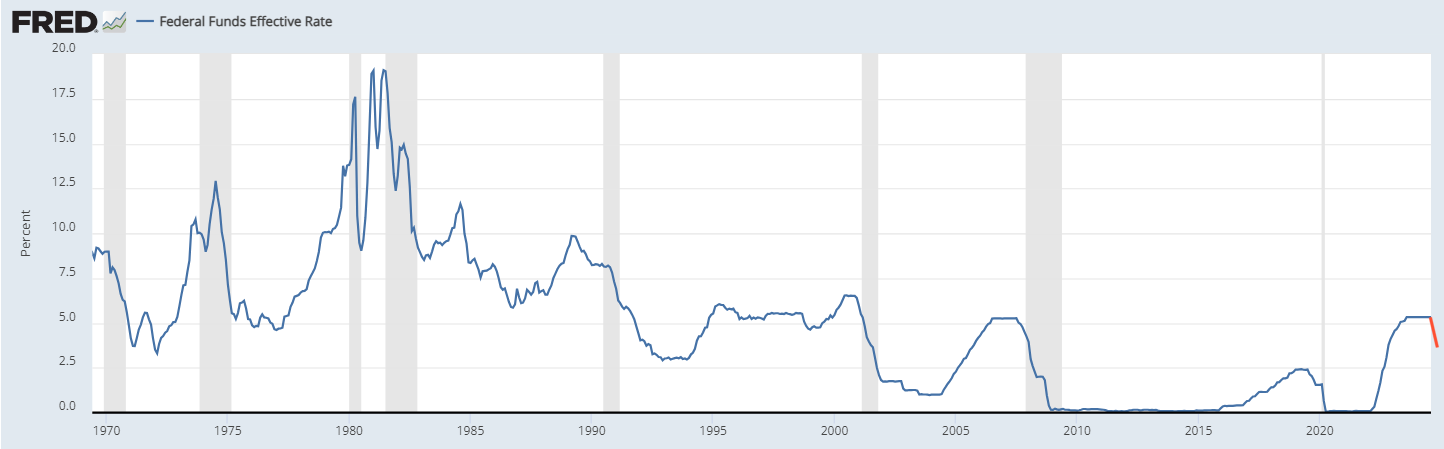

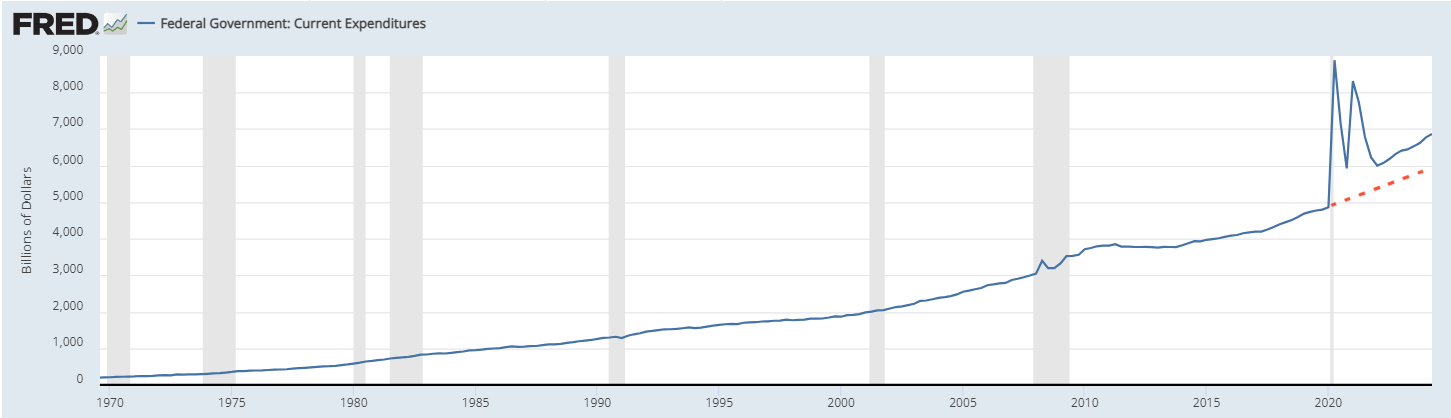

The Fed recently reduced interest rates by 0.5%, its first step in a planned series of rate reductions as inflation, unemployment, and other economic measures (below) seemingly indicate its objective of “a soft landing” might actually be achieved. Notably, the Fed has a very long record of moving too slowly and triggering a recession instead. However, there may be two important differences this time: (1) the extra $Trillion of Federal spending that helps keep the party going, and (2) being on the leading edge of the AI technology boom that both creates economic excitement and stimulates private investment when building it out.

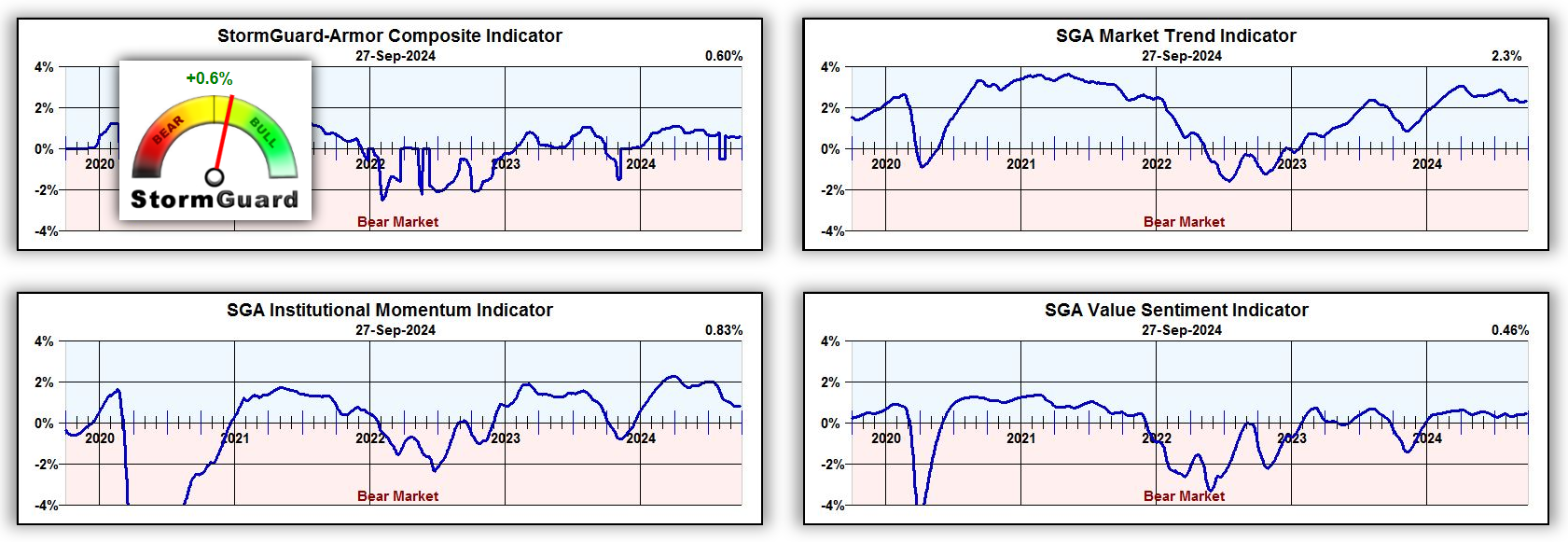

StormGuard Storyboard

The charts below tell the simple story of “steady as she goes.” While some of the heat has clearly come out of the market, all of the indicators appear stable – nothing declining. The comparatively lower value of the Value Sentiment Indicator suggests that relatively few stocks are responsible for the market’s performance. Meanwhile, the VIX market volatility indicator suggests confidence.

FRED: Federal Reserve Economic Data

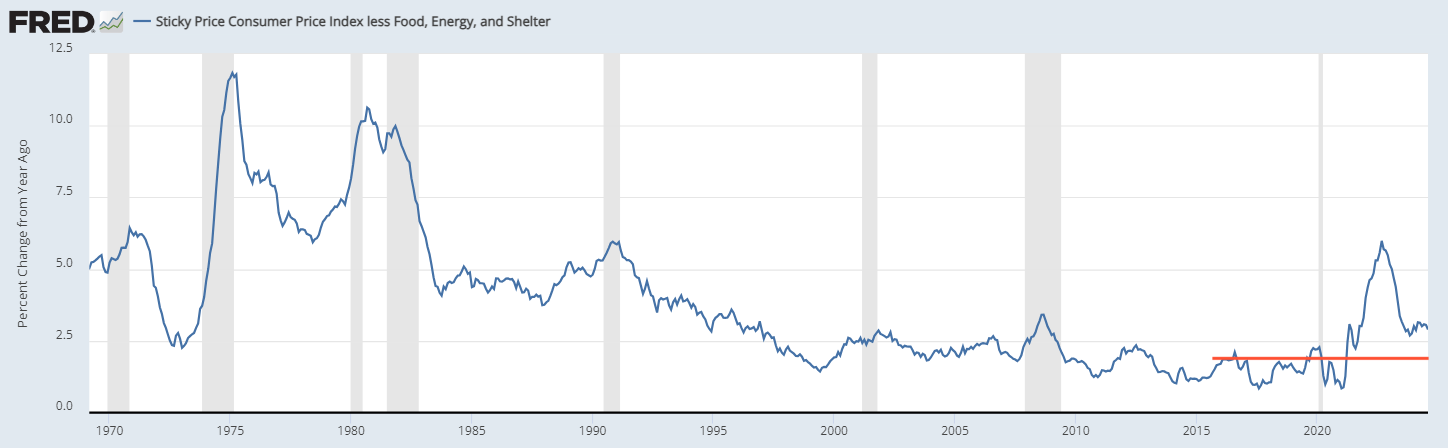

Let’s briefly run through the diverse set of charts (below), from the Fed’s own data charting service, and evaluate them against its plan to orchestrate a soft landing (no recession) for the economy.

(1) The Fed Just Started Reducing Rates.

Does the start of rate reductions predict the onset of a recession? Could this be backwards? When we confirm a recession, it is already 3 months old. Which was first?

Federal Funds Effective Rate

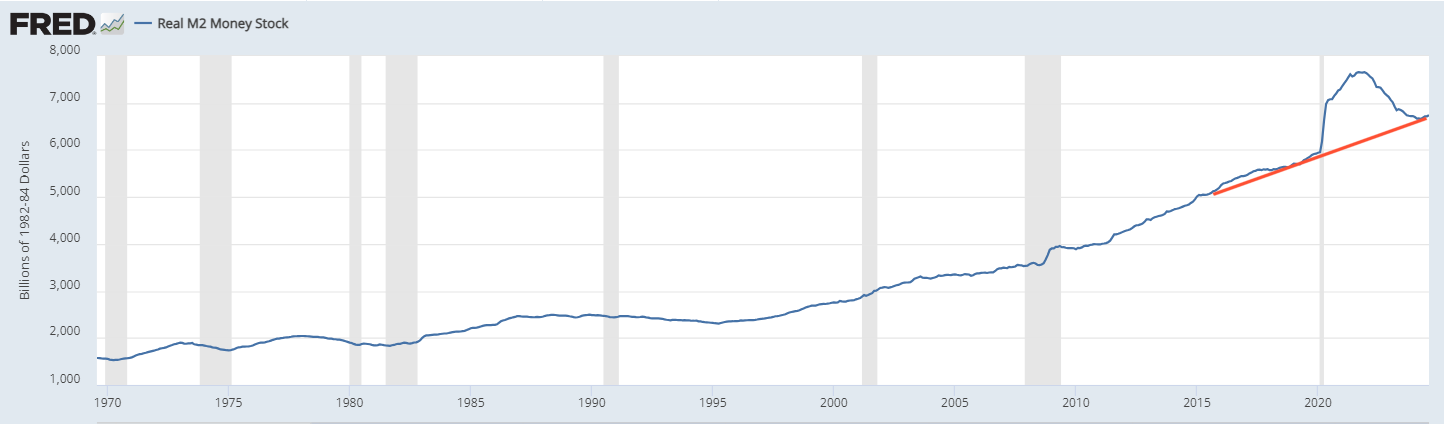

(3) The Fed’s Foot is Off the M2 Gas Pedal

Following COVID, the FED goosed the economy by adding about 20% to our currency stock. It appears that they have managed to reverse that stimulative action.

Real M2 Money Stock

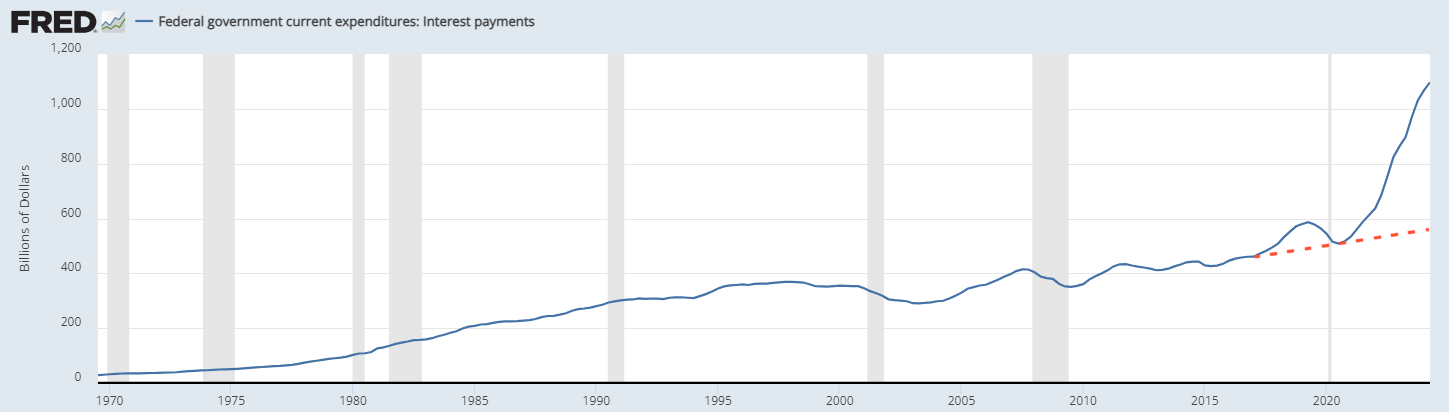

(5) Excess Spending Leads to Debt

The excessive Federal deficit spending creates debt load that crowds out other Federal spending. We have 1/2 $Trillion in new interest payments burdening the budget.

Federal Government Current Interest Payment

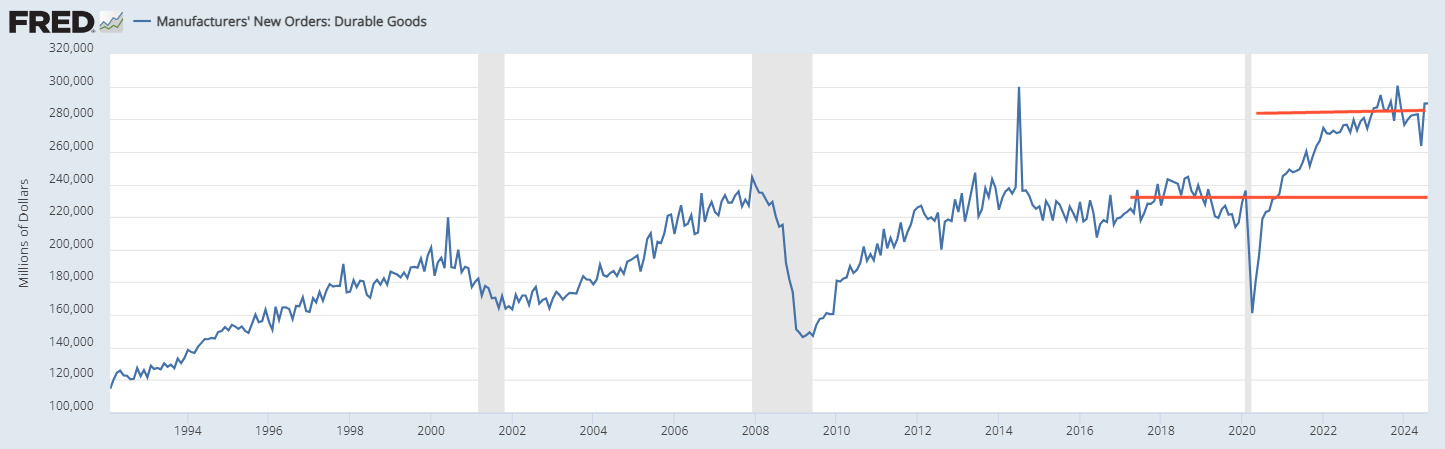

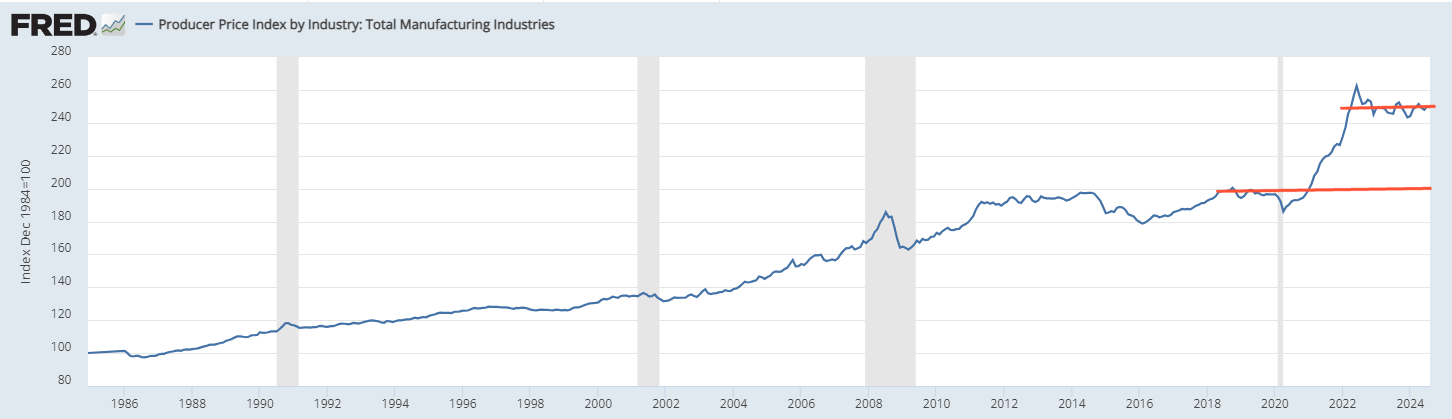

(7) New Orders Up Due to Inflation

While it may look like businesses are doing well and getting more orders, the unit numbers have remained the same. Inflation makes the orders seem larger.

New Orders of Durable Goods

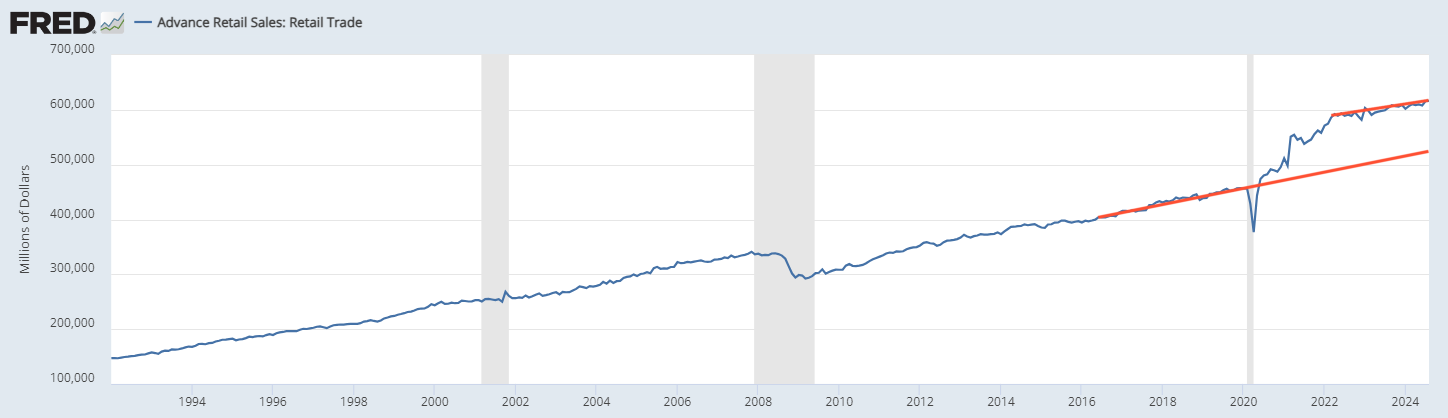

(9) Retail Trade Follows Inflation

The increase in retail trade of about 20% closely matches expectations from 20% inflation and purchases of the same amount of goods and services.

Retail Trade

Evaluating that Wall of Worry

Historically, regional wars, such as in Ukraine or Israel, have not measurably affected our markets. The US dockworker’s strike, while quite serious, will likely receive intense political pressure to ensure that the strike does not tip the scales in the coming presidential election. The outcome of presidential elections historically has had little effect on the overall markets. However, under the surface (at the sector level), a switch in political parties often causes a shift in sector leadership because changes in administrative policy inherently create new sets of winners and losers.

Perhaps the elephant in the room is the national debt, now at $35.4 Trillion and growing rapidly. While that may not end well, for now, excessive deficit spending may be a significant factor preventing a recession from taking root. Finally, the monetization expectations of AI seem to have both FOMO (fear of missing out) and a self-fulfilling prophecy going for it that could help keep any recession at bay.

Patience, not panic!

Rules, not emotion!

May the markets be with us!

Scott Juds

Chairman & CEO, SumGrowth, Inc.

AlphaDroid Website

AlphaSheet Website

Questions?

Schdule an Appointment

SectorSurfer Home

AlphaDroid Home

Disclaimers:

Investing involves risk. Principal loss is possible. A momentum strategy is not a guarantee of future performance. Nothing contained within this newsletter should be construed as an offer to sell or the solicitation of an offer to buy any security. Technical analysis and commentary are for general information only and do not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of any individual. Before investing, carefully consider a fund’s investment objectives, risks, charges, and expenses, and possibly seek professional advice. Obtain a prospectus containing this and other important fund information and read it carefully. SumGrowth, Inc. is a Signal Provider for its SectorSurfer and AlphaDroid subscription services and is an Index Provider for funds sponsored by others. SumGrowth, Inc. provides no personalized financial investment advice specific to anyone’s life situation and is not a registered investment advisor. See additional disclaimers HERE.