Active vs. Passive Portfolio Management

Classic Modern Portfolio Theory (MPT) is a passive portfolio management system where one selects a set of uncorrelated assets, sets allocation percentages for each, and periodically rebalances the portfolio's assets to bring allocations back in line with original targets. It is believed the market is inherently an unpredictable random walk. Thus MPT advocates buy-and-hold diversification.

Tactical Asset Management

Tactical Asset Management actively alters a portfolio's asset composition and/or allocation weights in response to changing market conditions. Because market cycles are tied to economic cycles and different market sectors do better during different phases of the economic cycle, the rationale for sector rotation is easily understood. Sectors provide the power strokes for a portfolio just like pistons in an engine. Although most professionals practicing sector rotation by periodically adjusting allocation weights to over-weight or under-weight market sectors, it turns out that optimum algorithmic trade performance is achieved by utilizing True Sector Rotation, where only the trend leader is owned from among a set of candidates. Not only are returns improved, but risk is reduced simply by avoiding the trend laggards. Furthermore, by combining multiple True Sector Rotation Strategies into a single portfolio, remnant volatility is further reduced. Risk is reduced by (a) diversification within a fund, (b) avoiding trend laggards, and (c) averaging the remnant volatility of multiple home-run hitters. Of course, return remains as the average of multiple home-run hitters.

Holistic Risk Management — Safety First!

Risk is not a one-dimensional problem cured by a single act of diversification. There are numerous sources of risk related to companies, funds, strategies, markets, political events, natural disasters, and even personal matters. Holistic Risk Management for investment algorithms examines and addresses the relevant sources of risk within an entire system utilizing a layered Portfolio-of-Strategies to measurably improve investment performance. AlphaDroid was designed to reduce risk on many levels, as described in our white paper "Conquering the Seven Faces of Risk".

SG-Armor Incorporates Event Detection, not Simply Timing Adjustments.

Most market sentiment indicators incorporate only measures of price change using one or more moving averages. Although there are many kinds of moving averages and many time periods over which they can be calculated, it is often the case that adjusting them to improve performance over one period of time results in reduced performance in others. Reacting more quickly generally results in additional whipsaw losses while reacting more slowly can result in going further over the cliff during a true market crash. The daily price record is limited in the amount of helpful information it can provide. In order to improve performance, additional information from other sources is required. Fortunately there are numerous measures of other market characteristics available, including daily volume, new highs and lows, advancers versus decliners and volatility. The objective is to find additional predictive information that can be used like "poker tells" to improve investment decisions.

StormGuard-Armor is the composite of three measures we call Price Trend, Market Momentum, and Value Sentiment. The Price Trend signal is essentially identical to the original StormGuard, which was derived from the application of Matched Filter Theory and performs measurably better than the classic 50/200 Death Cross. The Market Momentum signal further incorporates volume information, and may be thought of as a "tell" indicating that momentum traders are changing their behavior. Note that a Wall Street "momentum trader" defines momentum as daily volume times the rate of price change in much the same way as a physicist defines momentum as mass times velocity. However, ordinary trend followers generally mix the terms trend and momentum together by inherently ignoring the consideration of volume. The Value Sentiment signal incorporates new highs and lows information, and may be thought of as a "tell" indicating value investors are changing their behavior.

VIEW A 5-MINUTE DEMO OF OUR SOFTWARE

START YOUR 30-DAY FREE TRIAL

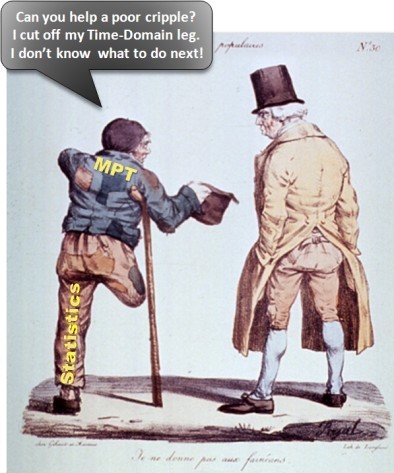

Why is MPT Blind to Market Trends?

MPT was developed over 65 years ago, and has long been the basis behind the financial industry’s two-fold investment methodology:

- Broad diversification within and between asset classes (such as stocks, bonds, money market, and commodities).

- Periodically rebalancing asset allocations back to the portfolio’s original target percentages.

Thus, the industry’s mantra of “diversify and rebalance.”

Here is a test of your observational skills — read the following Wikipedia definition of MPT and see if you notice what useful information MPT has discarded: “More technically, MPT models an asset’s return as a normally distributed random variable, defines risk as the standard deviation of return, and models a portfolio as a weighted combination of assets so that the return of a portfolio is the weighted combination of the assets’ returns. By combining different assets whose returns are not correlated, MPT seeks to reduce the total variance of the portfolio. MPT also assumes that investors are rational and markets are efficient.” So, what’s missing from this tactical asset allocation?

The answer is that all of the mathematical functions listed above include only statistical functions — which means that there can be no time domain analysis results, and thus no trend analysis results. This is why an MPT practitioner can tell you which five things to buy and hold based on statistical performance in the past, but cannot tell you anything about which of them would be best to own next month. In fact, because MPT incorrectly models an asset’s return as a normally distributed random variable and incorrectly assumes that markets are efficient, it inherently dismisses the existence of trend information, and follows by applying a suite of mathematical analysis tools that destroys the time domain information and thus can’t possibly answer the question, “Which funds would be best to own next month?”

The answer is that all of the mathematical functions listed above include only statistical functions — which means that there can be no time domain analysis results, and thus no trend analysis results. This is why an MPT practitioner can tell you which five things to buy and hold based on statistical performance in the past, but cannot tell you anything about which of them would be best to own next month. In fact, because MPT incorrectly models an asset’s return as a normally distributed random variable and incorrectly assumes that markets are efficient, it inherently dismisses the existence of trend information, and follows by applying a suite of mathematical analysis tools that destroys the time domain information and thus can’t possibly answer the question, “Which funds would be best to own next month?”

As an analogy, consider an Iowa farmer wanting to know if now is the time to plant his corn. He contacts the Modern Portfolio Farm Agent and is told the following:

- The average world temperature today was 62F.

- The average temperature in his town for the last decade was 58F.

- The temperature in his town is most well correlated with that of Hamburg, Germany, and most uncorrelated with that of Sydney, Australia and La Paz, Bolivia.

- The standard deviation of temperature from average is 3.5F within his state.

After pondering all of this great information, the farmer still has no idea whether to plant corn or wait another week. There is no temperature trend information whatsoever from which the farmer might be able to improve his chance of having a great crop this season.

What should a farmer do with the Modern Portfolio Farm Agent’s advice? It’s obvious — run out and buy a few other farms scattered around the world to abate the risk of any one of them doing poorly, but certainly not waste time trying to improve results by observing trends in the weather, pests, or environmental regulation. Hmmm…

- By discarding time domain information, MPT is inherently unable to suggest what to buy or sell next month.

- MPT may be ideal for “buy and hold” investors, but “buy and sell” decisions require time domain data analysis.

The Tactical Asset Management school says that avoiding losers altogether reduces risk without punishing returns. Therefore, monitor the trends of each candidate fund and sell the poorly trending ones in favor of owning only the nicely trending ones. This fits well with Mark Twain’s humorous suggestion, quoted from his 1894 novel Pudd’nhead Wilson: Behold, the fool saith, “Put not all thine eggs in the one basket” – which is but a manner of saying, “Scatter your money and your attention”; but the wise man saith, “Put all your eggs in the one basket and – WATCH THAT BASKET.”

Today, even the originator of the EMH (Efficient Market Hypothesis), Nobel laureate Eugene Fama, acknowledges returns associated with momentum are pervasive.

It’s time to extend MPT’s framework.