AlphaDroid

High Performance Algorithms and Portfolios

Leveling the playing field for wealth managers

AlphaDroid investment strategies and portfolios level the playing field with Wall Street by putting the power of award-winning, high-performance investment algorithms in your hands.

Designed by and for advisors, our True Sector Rotation algorithm owns the momentum leaders in bull markets, and our StormGuard algorithm invokes a Bear Market Strategy algorithm to protect and grow your assets during bear markets.

Watch this 1-minute video and you’ll appreciate the power of AlphaDroid.

AlphaDroid's Proven Strategies for Better Returns

Only the momentum leader can improve returns and reduce risk.

Owning only the trend leader can improve returns and reduce risk. AlphaDroid strategies use our proprietary momentum algorithm to automatically select the highest trending stock or fund from a list of up to 12 candidates. Different market sectors perform better during different phases of the economic cycle.

Sectors provide the power strokes for a portfolio just like pistons in an engine!

We Approach Risk Differently. Meet StormGuard

The best way to reduce risk is to avoid it. Our proprietary StormGuard™ Bull-Bear Indicator continuously assesses U.S. equity market risk and rotates AlphaDroid strategies into defensive holdings when a Bear Market is indicated. Strategies rotate back into bull positions when the StormGuard Bull-Bear Indicator is positive.

StormGuard, our proprietary Bull-Bear Indicator drives our process to:

- Select defensive funds

- Avoid rather than dilute risk

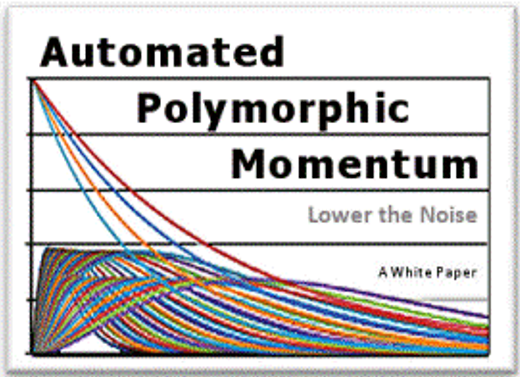

Cleaner momentum signals lead to better decisions.

Momentum Detection: It’s About Reducing Noise

The performance of momentum investing depends on its proficiency in extracting trend signals from noisy market data. Our advanced signal processing algorithms employ the cross-disciplinary sciences of Matched Filter Theory and Differential Signal Processing – the same technologies that enable WiFi, USB, iPhones, and remotely controlled rovers on Mars to perform so well.

Our goal is to produce low noise momentum that leads to:

- Better fund selection

- True sector rotation owning only the leader and avoiding the laggards

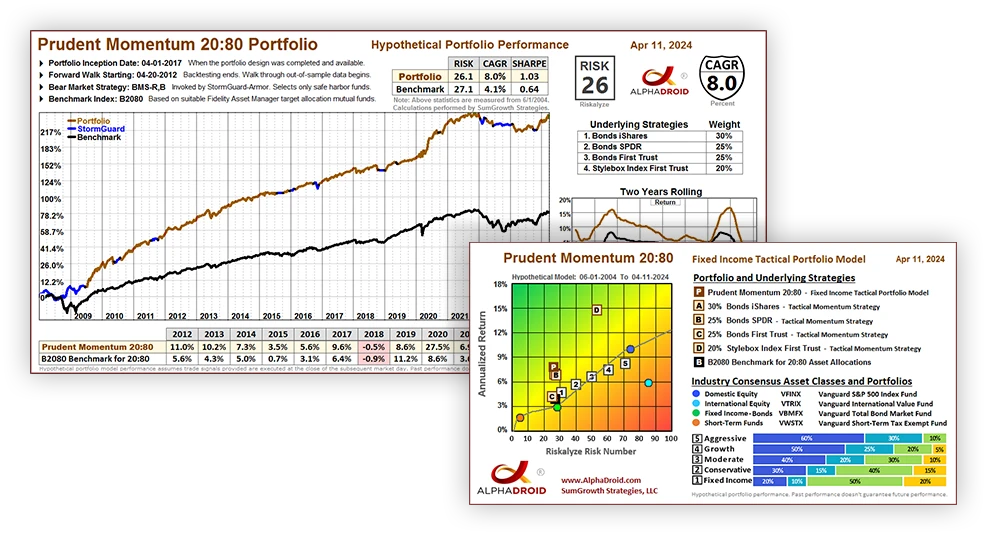

Example: The SNUG Tactical Risk Mitigation Portfolio

The SNUG Tactical Risk Mitigation Portfolio is our flagship defensive portfolio designed for conservative investors seeking steady growth. The portfolio is made from four underlying strategies that utilize our cutting-edge rules-based momentum algorithm to select trend leaders from a diverse universe of over 60 ETFs, including bonds, treasuries, gold, and the S&P 500. With a 60/40 backbone and the inclusion of defensive ETFs to challenge momentum leadership, the Tactical Risk Migitgation Portfolio offers a superior approach to defensive investing.

Choose the Subscription that Fits Your Needs

Streamlined and simplified

- 16 exceptional Model Portfolios

- Trade Signals

- Client-friendly charts and statistics

- A weekly Sunday Snapshot of current market activity

Expansive tools for portfolio creation

- Includes AlphaSheet

- Select from among our professional-designed Portfolios

- Create and edit portfolios of your own design

- Note: You cannot create or edit underlying strategies held by a portfolio.

Deepest capabilities for nearly unlimited choice

- AlphaDroid subscription plus

- Import, edit, or create your own strategies to better address specific client needs

- Test your own ideas

Compare Subscription Plans

| AlphaSheet | AlphaDroid | AlphaDroid Advanced Quant | |

|---|---|---|---|

| AI - Automated Momentum Optimization | ✓ | ✓ | ✓ |

| AI - Dual Defense: StormGuard + TrendGuard | ✓ | ✓ | ✓ |

| Improved Low-Noise Momentum Selections | ✓ | ✓ | ✓ |

| Ready-Made Professional Portfolios | 16 | Dozens | Dozens |

| Ready-Made Momentum Strategies | 41 | Hundreds | Hundreds |

| Your Own Custom Portfolio Designs | - | 200 | 200 |

| Your Own Custom Strategy Designs | - | - | 500 |

| 401K Strategy Multi-Pick Support Tool | - | - | ✓ |

| Email & Video Conferencing Tech Support | ✓ | ✓ | ✓ |

| Email & Text Message Trade Alerts | ✓ | ✓ | ✓ |

| White Label Branding with Your Logo | ✓ | ✓ | ✓ |

| Access | Monthly Newsletter | Platform + Monthly Newsletter | Platform + Monthly Newsletter |

$299/Month | $499/Month | $699/Month |

AlphaDroid

Your AlphaDroid Trial Subscription Includes

-

Ready-to-Use Investment Strategies

Access dozens of ready-to-use strategies and portfolios suitable for a wide variety of client types.

-

Advance Momentum Algorithm

AlphaDroid strategies use our proprietary, advanced momentum algorithms to select the best-trending fund from a pool of up to 12 candidates based on market trends.

-

Effective Strategy Management

Manage up to 500 investment strategies and 200 portfolios for efficient client account organization.

-

Market Crash Protection

AlphaDroid's StormGuard algorithm advises strategies to move to safety during market downturns, preventing significant losses for investors.

-

Design Custom Strategies

Create custom investment strategies from scratch using AlphaDroid's financial planning tools for both advisors and investors.

-

Automated Trade Alerts

You'll receive Trade Alert email notifications when your strategies make new trades.

Keys to AlphaDroid's Dual Defense

Our proprietary Dual Defense strategy seeks to protect against downside risk and underperformance.

Our market risk monitor seeks to identify bull or bear conditions to inform automatic switching between equity growth and defensive positions.

Our unique defensive backstop fund strategy seeks to protect against underperformance when market momentum is interrupted.

Bear Market Indicated

- Portfolios rotate automatically to bear market strategies.

- Strategies select momentum leaders from a set of defensive set of funds.

- Fund candidates include bonds, treasuries, commodities, and others.

Bull Market Indicated

- Portfolios select momentum leaders from candidate equity funds.

- Momentum leaders are compared to TrendGuard, our “backstop” strategy designed to act as a performance floor.

Leverage AlphaDroid For Your Practice

The AlphaDroid is a great fit for RIAs who:

Conquering The Seven Faces of Risk

"This book is one of the very few ‘must read’ books. For those who have been burned by the ‘diversify and rebalance’ mantra, Conquering the Seven Faces of Risk is sorely needed, and Scott Juds truly delivers. As a fiduciary, I find SectorSurfer’s risk mitigation algorithms to be so far superior to the conventional buy-hold-and-rebalance models that I cannot justify risking my clients’ assets with the latter. I am impressed with Scott Juds’ mission to educate the retail investing community."

David Yeh, MD, (Retired Nuclear Physician), Investment Advisor, and Author of The Busy Doctor’s Investment Guide

- The FEDS (FINRA, ERISA, DOL, SEC) are silent on quantitative measures defining suitable and prudent risk management.

- While a wide latitude helps advisors satisfy client needs, it provides no basis for defense in a risk management audit.

- However, industry consensus definitions for risk-ranked portfolios are entrenched and accepted by the FEDS. Thus, their risk measures quantify suitable and prudent risk.

- Extracting trend signals from noisy market data in a manner that has been the most predictive of next month's performance.

- Walking forward in time through new out-of-sample data using the previously determined best performing momentum algorithm.

- Fully automating the process to allow investor to focus on the higher level task of choosing candidate sets of funds that play well together.

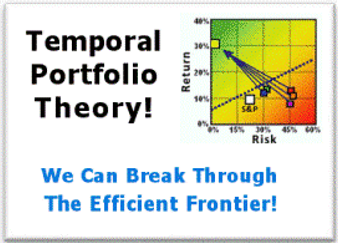

- Modern Portfolio Theory is 65 years old, developed long before computers could analyze daily time domain data.

- Temporal Portfolio Theory extends MPT by utilizing the cross-disciplinary sciences of Holistic Risk Management, Matched Filter Theory and Differential Signal Processing

to improve overall investment performance. - Only by owning the trend leader and avoiding the laggards can one simultaneously improve returns and reduce risk!