Posts by Alpha Droid

Exchange-Traded Fund Strategy

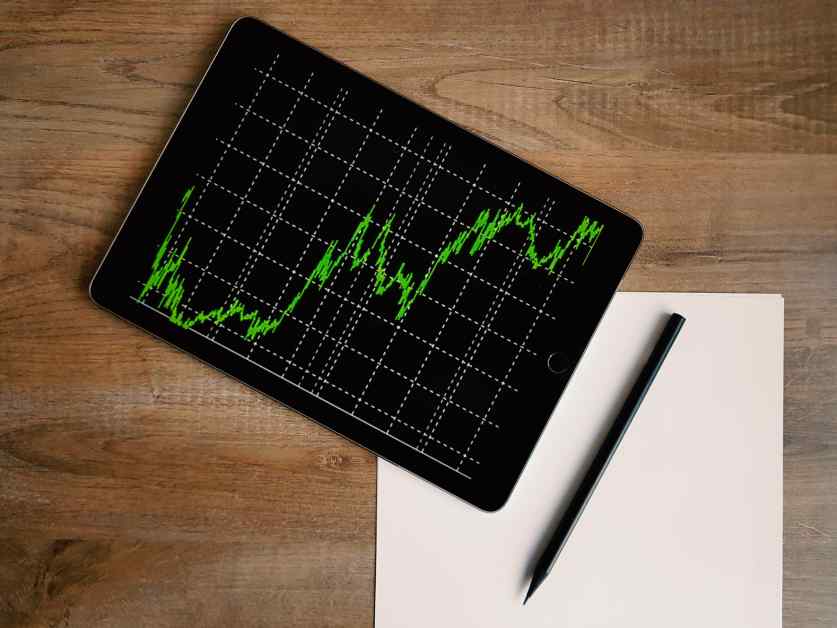

Financial advisors and investors use a variety of algorithmic trading strategies to reap returns for their clients. Different strategies are used depending on the goals of the client and what the financial advisor wants to achieve. Some of these strategies produce long-term results while others provide short-term results. However, all of these strategies have commonalities.…

Read MoreFactor-Based Investing Algorithmic Trading Strategy

Algorithmic trading strategies are used by financial advisors, investors, and traders to quickly execute orders when stocks reach a certain price. Computers are programmed with specific metrics and alert the trader when those metrics are detected. While there are a variety of algorithmic trading strategies used, they all share particular traits. One trait they share…

Read MoreThe Mean Reversion Strategy

Using computer programs to trade quickly based on specific criteria, algorithmic trading helps financial advisors and investors execute orders fast when a particular stock reaches a desired price or drops below a specific price. The criteria can be based on a variety of aspects including stock prices or certain market conditions. There are many different…

Read MoreMomentum Investing 101

Algorithmic trading, simply put, uses computers that are programmed to take specific steps in response to the market data it is receiving. There are many algorithmic trading strategies that are used for a variety of reasons by financial advisors and investors who are looking for portfolio returns while taking risk out of the equation. Some…

Read MoreWhich Market Trends You Need to Be Concerned With

The finance industry is a challenging one to keep up with. When you’re working with the money of your clients, one thing is for sure — you need to stay on top of every little change. Even though providing financial guidance to your clients is your job, it can be extremely challenging to provide them…

Read MoreReasons to Open Your Own Financial Advisory Practice

Working in the financial advisory industry is incredibly rewarding. Though there are plenty of opportunities to join a financial advisory firm, there are endless advantages to starting your own practice. In today’s blog, the team at Alpha Droid is going to cover a few of the benefits that you’ll be able to enjoy when you…

Read MoreWays Traders Can Improve Trading Discipline

Discipline. It is something every trader wishes to improve, heck, maybe it even made it on the ‘New Year’s Resolutions for Trading’ list. Undoubtedly, discipline is one of the most essential trait traders need to increase their chances of success. A lack of discipline is one of the leading cause of trading mistakes — such…

Read MoreHow to Gain A Competitive Edge Over Major Indexes in Stock Trading

Trading stocks can be a very competitive endeavor to get into. Large corporations, hedge funds, and other professional financial managers have long held a distinct advantage over the average trader by utilizing proprietary complex financial analysis algorithms coupled with mainframe computers and streaming market data to achieve investment results that are far superior to the…

Read MoreTips To Improve Trading Results

Many traders are simply putting in the hours, thinking that if they spend enough time around the markets, analyzing charts, reading books, and taking online courses, their skill level will improve. While it’s important to have a solid understanding of trading, putting in extra hours won’t necessarily increase a traders potential profit. In fact, many…

Read MoreTips To Help You Better Understand Algorithmic Trading

Algorithmic trading is one of the most efficient and innovative trading strategies that both short-term traders and long-term investors can utilize to increase their profits while mitigating risk. Basically, algo trading is a form of trading that is based on a set of predefined rules or instructions, accounting for past data in volume, price, and…

Read More